- This post originally appeared in the Insider Today newsletter.

- You can sign up for Business Insider's daily newsletter here.

Almost Friday! Flight delays and cancellations stink, but here's some good news: A new regulation requires airlines to process automatic refunds.

In today's big story, we're looking at how millennials have seen their wealth explode over the past few years.

What's on deck:

-

Markets: Meet the mom-and-pop investors who got in on Nvidia before the hype.

-

Tech: Meta shares tumble despite Mark Zuckerberg laying out plans for AI investments.

-

Business: These 20 private-equity firms are making big moves in sports.

But first, we're back!

If this was forwarded to you, sign up here.

The big story

Millennial money makers

They laughed at our avocado toast. They laughed at our skinny jeans. But who's laughing now?

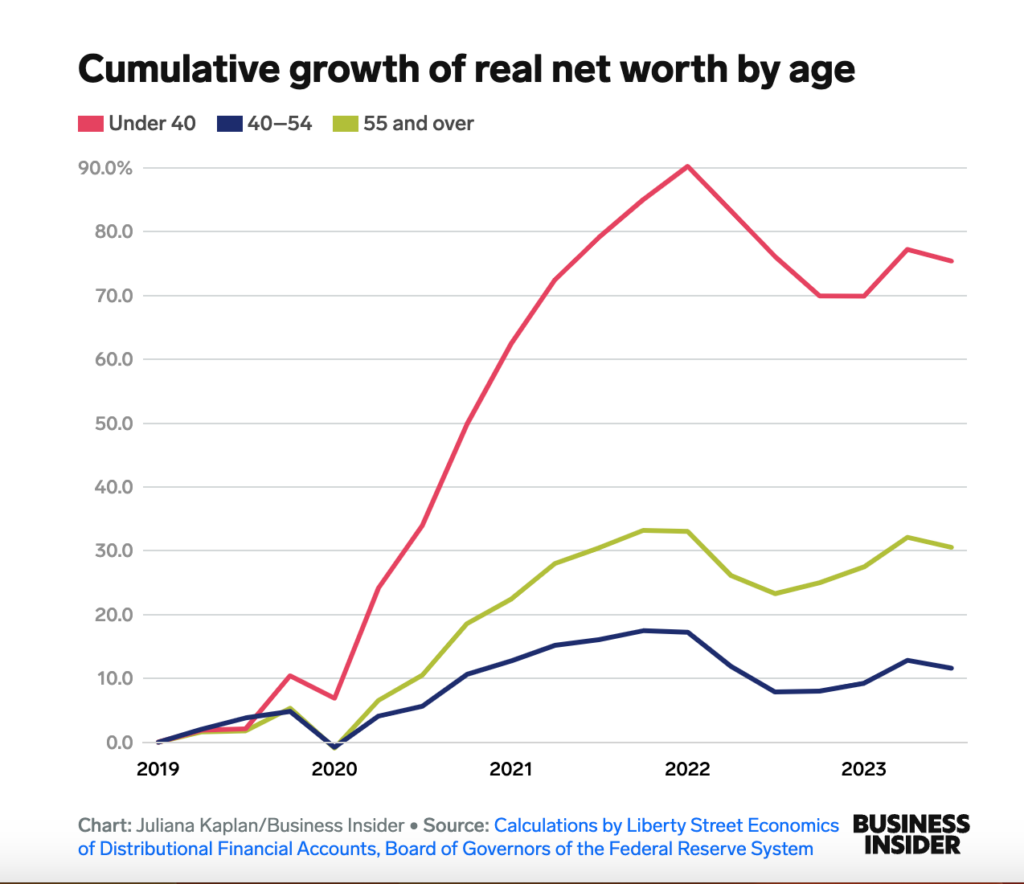

Millennials, the oft-maligned generation, are a lot better off financially than you might realize. A new report found millennials saw their wealth double from the end of 2019 through 2023, writes BI's Juliana Kaplan.

It's an incredible turnaround for a generation constantly beaten down for making what some deemed to be financially frivolous decisions. Turns out that enjoying the occasional overpriced brunch while writing Harry Potter fanfiction didn't ultimately lead to personal bankruptcy.

Disclaimer: Yes, I am a millennial. Yes, my feelings are still hurt from all your mean tweets.

Perhaps you're unimpressed. Millennials were between the ages of 23 and 38 in 2019, prime earning years. But their wealth grew much faster than how boomers and Gen Xers fared at that age.

Millennials had a few things break their way, though.

First, a strong post-pandemic job market allowed them to amp up their earning power. It also came at the perfect time. Unlike many of their elder colleagues eyeing retirement or with families to consider, millennials were free to job-hop to higher salaries amid the Great Resignation.

But millennials also put that money to work. The market downturn from Covid presented an opportunity for millennials to buy into blue-chip companies at bargain prices.

And thanks to the rise of no-fee trading, they could do it more cost-effectively than previous generations.

But it's not all going swimmingly for millennials.

Millennials' wealth has grown exponentially over the past few years. But so have the important things they need to pay for.

Home prices and mortgage rates have been on the rise. And that's if millennials can even find a home. These days, the housing market is a bit of a ghost town.

That's not the only cost millennials are suffering through with their newfound wealth. Childcare is becoming an incredible burden for young families. Chalk that up as another win for the DINKs.

But millennials' biggest enemy might ultimately be themselves.

A 2023 survey found millennials felt they needed $525,000 a year to be happy. That figure was well above what Gen Z ($128,000), Gen X ($130,000), and boomers ($124,000) wanted.

Call it the result of growing up in the #hustleharder culture. Call it lifestyle creep. Call it the disease of more.

Whatever the case, millennials' wealth can keep growing. It still might not be enough.

3 things in markets

-

They liked Nvidia before it was cool. These investors backed Nvidia long before it became an AI icon and stock-market darling. Their gains have paid for everything from cars and vacations to dream homes.

-

Jamie Dimon is still worried about the state of the world. JPMorgan's CEO said consumers are in good shape, even if a recession ultimately hits. But various international conflicts have led to "probably the most complicated and dangerous" geopolitical situation since World War II, he said.

-

Trump Media gets Congress involved in its latest crusade. CEO Devin Nunes filed a letter on Tuesday that urged House Republicans to look into the possibility that the company's stock, which has plummeted over the past month, has been a victim of so-called "naked" short selling.

3 things in tech

-

Meta disappoints. The social media giant posted its first-quarter earnings report after Wednesday's opening bell — and its stock tumbled in Thursday's premarket. CEO Mark Zuckerberg laid out a plan to splash the cash on AI investments — but that didn't distract investors from Meta's lackluster revenue forecast.

-

Amazon has suspended new US Green Card applications for foreign workers. According to a leaked memo, the company put the applications on hold for the rest of the year. It could be a sign Amazon is concerned about uncertain labor market conditions.

-

Why is it so hard to prove you're not a robot? Captcha tests have been around for years, but they've become increasingly difficult — and annoying — recently. There's got to be a better way to prove you're actually a human.

3 things in business

-

Google, once again, is dictating the future of the online ad industry. Google's latest delay in eliminating cookies, announced Tuesday, has the rest of the industry frustrated. Experts say the delay's outsized effect underscores how powerful Google's influence has become.

-

Private-equity firms are making power plays in sports. As teams embrace outside investors, firms like Apollo, Blackstone, and KKR are funneling money into sports. We rounded up 20 firms moving into the hot space, as well as the leading dealmakers helping investors get a piece of the action.

-

McKinsey's in hot water. The Department of Justice is investigating the consultancy for its past work advising opioid companies about how to boost their sales, The Wall Street Journal reported on Wednesday. McKinsey has long been under scrutiny for its work with various drugmakers and has paid nearly $1 billion to all 50 states, Native American tribes, local governments, and other groups to resolve a host of lawsuits without admitting wrongdoing.

In other news

-

Jefferies CEO sold $65 million in stock to buy a yacht from a client.

-

Sundar Pichai admits the generative AI boom took Google by surprise.

-

The TikTok divest-or-ban bill is a First Amendment disaster, but it may still stand up in court.

-

Private equity is getting into the special education business. It's not all going smoothly.

-

S&P 500 is at risk of crashing 44% — and selling early could pay off, says elite forecaster.

What's happening today

-

Today's earnings: Alphabet, Microsoft, Snap, and other companies are reporting.

-

Today's the first round of the NFL Draft.

-

The US Supreme Court hears former President Donald Trump's immunity claim in the 2020 election interference case.

The Insider Today team: Dan DeFrancesco, deputy editor and anchor, in New York. Jordan Parker Erb, editor, in New York. Hallam Bullock, senior editor, in London. George Glover, reporter, in London.